Mileage Reimbursement Rate For Business 2024 – Mileage reimbursement rates are determined by the IRS. Charges for gasoline, accessories, repairs, depreciation, anti-freeze, towing, insurance, auto club memberships and other expenditures are . a personal finance and business coaching company. Note that for 2024, the IRS mileage reimbursement rate is 67 cents for employees or a self-employed individual traveling for work, up from 65.5 .

Mileage Reimbursement Rate For Business 2024

Source : mileiq.comIRS Announces Increased Business Mileage Rate for 2024

Source : www.driversnote.com2024 IRS Business Mileage Rate of 67 Cents Informed by Motus Data

Source : www.motus.com2024 IRS Mileage Rates: What to Expect

Source : www.lewis.cpaKatie Theriault on LinkedIn: 🚨🚨 .67 CPM for 2024 🚨🚨

Source : www.linkedin.comIRS Mileage Reimbursement Rate 2024 All You Need to Know

Source : matricbseb.comHawaii Employers Council IRS Issues Standard Mileage Rates for 2024

Source : www.hecouncil.orgFree Mileage Log Template | IRS Compliant | Excel & PDF

Source : www.driversnote.comUpdated Standard Mileage Rates for 2024

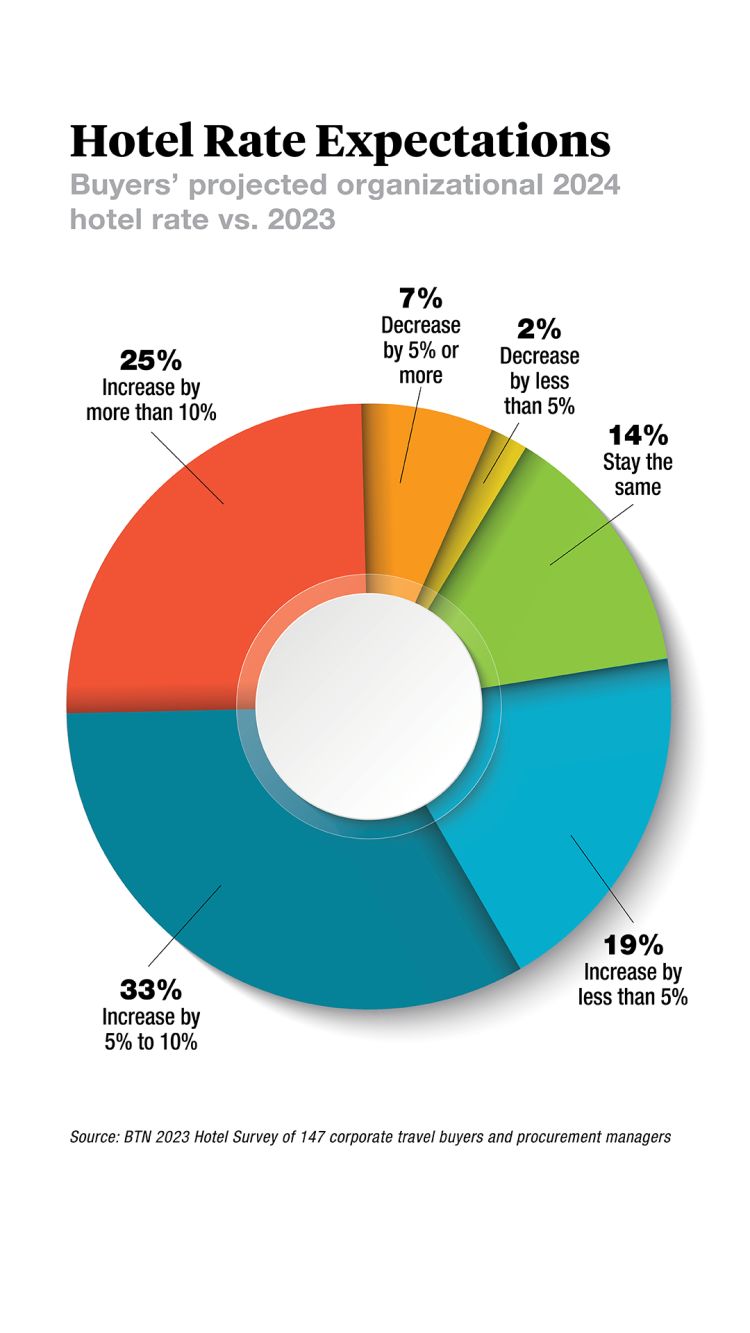

Source : markham-norton.comBuyers Consider Changes to Mitigate 2024 Hotel Rate Hikes

Source : www.businesstravelnews.comMileage Reimbursement Rate For Business 2024 The 2024 IRS Mileage Rates | MileIQ: Business and travel expenses should be paid through appropriate buying and paying methods, but, as an employee, you might incur expenses with out-of-pocket funds. You can request reimbursement in . Leslie Bonilla Muñiz,5, 2024 Need an ambulance? Some Hoosiers might find themselves out of luck. The state has lost hundreds of paramedics, emergency medical technicians (EMTs) and ambulances since .

]]>